Term Deposits – all you need to know

When it comes to term deposits there are a range of options on the market. Many individuals use term deposits to gain a little extra on their savings. However, advisers use term deposits to reduce risk and increase liquidity within portfolios. We believe it’s important to understand how all aspects of a term deposit before […]

Switching Super Funds – What you need to know

Ever heard about consolidating your super? Curious as to what affect it can have on your retirement? Choosing the right superannuation product, amongst other things, is an important decision to make. Unfortunately, it’s not as simple as choosing the fund with the highest performance and then moving everything across to that fund. There’s much to consider […]

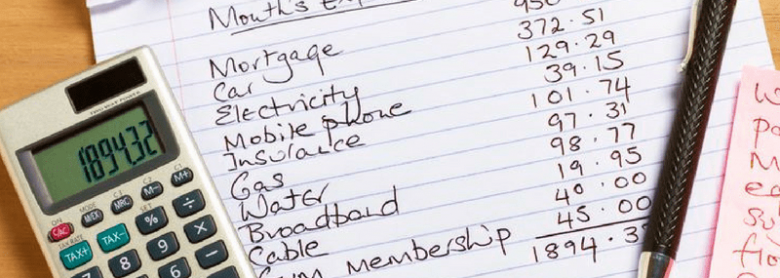

Five reasons why budgeting is so important

We never stop hearing about the importance of budgeting in our day to day lives and this is rightly so. The substantial benefits far outweigh the time cost both in the short and long term. In our current market climate budgeting is more important than ever to ensure you and your family have financial security […]

Many borrowers have taken out interest only loans without fully considering the risks and limitations associated. The Reserve Bank of Australia (RBA) have made the decision to hold the current cash rate at 1.50 per cent. However, some major banks in recent months have increased their retail interest rates. This is already putting some borrowers […]

Unclaimed & lost super tops $18 billion

Recent data released by the Australian Tax Office (ATO) shows that Australia’s pool of unclaimed superannuation has increased from $3.2 billion to $3.75 billion. The total of unclaimed and lost super is close to $18 billion, which is continuing to rise. On 31 December 2016, the ATO increased the threshold at which super funds must […]

Case study: An Executor Sued

Ensuring your estate planning arrangements are adequate to meet your needs is vitally important for both you and your family. We have provided the following case study to highlight a scenario that identifies why estate planning is important. John lived in Moree. A divorced ex‑shearer and farm hand, he had two sons whom he hadn’t […]

DocuSign: Signing documents electronically

DocuSign is the paperless way we handle documents here at Total Advice Partners. It makes for a simple workflow and approval process. It is a secure and fully digital process that allows you to get on with your business and everyday life. DocuSign allows us, and you, to send, sign and approve documents from wherever life […]

Property Investors Preferences

New data has revealed that property investors prefer to purchase older dwellings rather than off-the-plan newly built homes. Mortgage Choice’s Annual Investor Survey found 76.9% of Australians intend to buy or have bought an existing dwelling., compared to that of 23.1% who purchased a new build. The data shows there is an increasing portion of […]

More retirees doing it tough of late

As the cost of living continues to increase, retirees are being hit hard – with many being pushed outside their comfort zone. The vast majority of retirees are now being forced to assess or alter their ongoing retirement plans and associated expenditure requirements. The industry peak body, Association of Superannuation Funds (ASFA), has released new […]

3 risks which could derail your portfolio

Long-term wealth accumulation and retirement saving must be considered no matter what age you are. However, we must first consider three of the major risks which have the ability to destroy your chances of building your desired levels of long term wealth should they not be addressed. The term risk is something we hear in […]