Young Investors – Where to invest their money?

With property assets at an all time high… where else can young people invest their money? In a time where the property market is in a boom and leaving young investors behind we must ask, is there other areas young investors should be looking to invest their money? Many run down houses in property booming […]

Alternative vs Traditional Style Investments

Retirement: “safe income”: stocks being favoured in current market conditions In our current market, investors are looking outside the ‘norm’ of traditional investments to gain access to the returns which once flourished in our portfolios. This is specifically the case for retirees who have in the past relied upon strong income returns from fixed interest […]

Under insurance – the risk exposing Australians

Australia is among the worlds most under insured countries in the world. It’s no secret that not enough for Australians to hold life insurance, and recent research in this area has highlighted the issue. Research conducted by TAL, a major industry insurer, has shown that only 30%-70% of Australians aged 18-69 hold life insurance, while […]

Should you reconsider your existing lending agreements? There have been changes made to the rules of how Self-Managed Super Fund’s (SMSF) can borrow from related parties. Since these changes were introduced earlier in the year we have seen a lot of talk about this topic and areas within the market which may have been awaiting […]

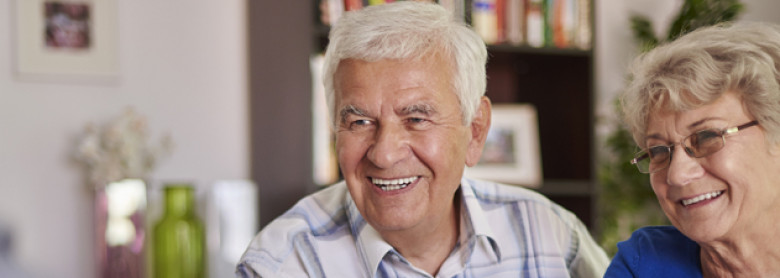

Pension Changes – 2017 Onwards

What are the changes? How will they affect me? Will they affect my current age pension benefit? These are the questions a lot of clients are asking us (Total Advice Partners) when we meet. This article will hopefully clear up the specifics around the proposed pension changes and provide you with a better understanding of things […]

How Trump’s victory divided the market

Since Donald Trump was elected and won the 2016 US Presidential election the US Stock market and other markets around the world have experienced significant changes. In the fortnight following Trumps election we have seen a rise in the US Stock Market of more than 3%. This increase in performance is not across the board […]

Late last Friday afternoon, the Government released for public consultation, the third tranche of exposure draft legislation. This is in relation to the superannuation reforms initially announced in the 2016-17 Federal Budget. This third round covers the lowering of the annual (after-tax) non-concessional cap to $100,000 and to restrict the eligibility to make non-concessional contributions […]

On 27 September 2016, the Government released the second tranche of draft superannuation legislation to give effect to some of the measures announced in the 2016/17 Federal Budget. This included the introduction of a transfer balance cap of $1.6 million, which will limit the amount that can be transferred to the pension phase of superannuation, […]

![[INFOGRAPHIC] Proposed super reforms](https://www.totaladvice.com.au/wp-content/themes/total-advice-partners/lib/image_resize.php?src=https://www.totaladvice.com.au/wp-content/uploads/2016/10/super.png&w=780&h=278&zc=1)