The fact that there are actually 100s of types of life insurance in the market today is enough to make anyone who is contemplating having life insurance turn and run away. Just imagine sorting through hundreds of complex and detailed insurance policies!

Having to face hundreds of varieties of life insurance could also bring more difficulty in deciding which life insurance complements your needs. However, it may come as good news that despite this influx of life insurance types, they are categorised into four types.

By narrowing down those hundreds to four, it makes the homework much easier and decision making less of a dilemma.

Why is personal insurance important? Claims stats

You’ve worked to give yourself a good income, and your income is going to play a big role in your lifestyle, and that of your family, for a long time to come.

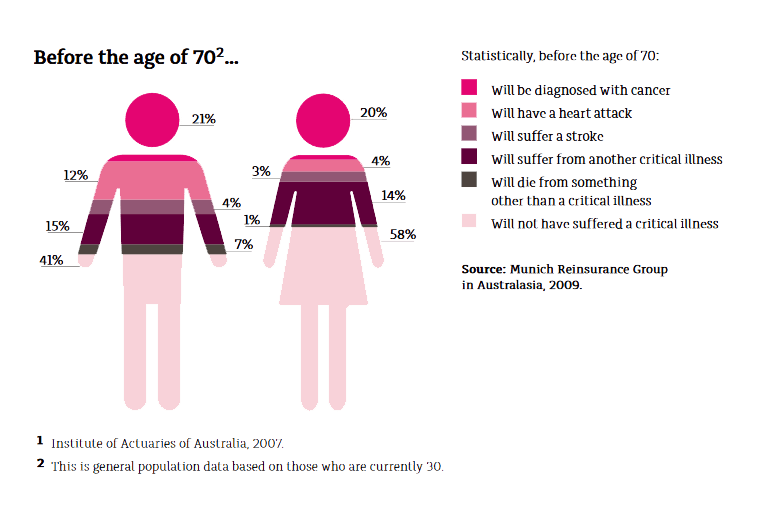

It sounds like something you’d want to protect, right? But under-insurance is an issue facing an alarming number of Australians, from all walks of life.

The insurance we’re talking about is life insurance – the most common forms of which are death cover, total and permanent disability (TPD), trauma insurance and income protection.

Life insurance isn’t just about protecting your family financially if you die. It’s about protecting your lifestyle if you get sick or injured. So if you can’t work for a while, or ever again, you’ve got a financial back-up plan.

Think of all the cases of physical and financial hardship you’ve seen in your profession. Then imagine it was your family that had to go through it all without financial support.

Many people are self-employed, adding another layer of financial responsibility to the equation.

But despite their significant insurance needs, many small business owners are also failing to protect themselves and their families with adequate insurance.

According to a 2006 survey by the Investment and Financial Services Coucil (FSC), less than half of small business owners feel they have adequate cover .

So if they know they’re not properly covered, why aren’t they doing something about it?

One of the reasons is that there's a perception insurance is too expensive.

But think about the sort of money you’d lose if you couldn’t work for a few months. Or worse, if you could never work again. It certainly helps put the cost of insurance into perspective.

How much cover do I need?

How much insurance cover you need for different life insurance types is vitally important if you want to ensure your family is not left in financial despair should something happen to you and you were no longer able to provide for them. To make certain that you're not under-insured you have to take several things into consideration, such as the following:

- Your family’s financial situation in the future as well as now. Many people do their maths on their present financial situation when assessing how much life insurance they need but as we all know, nothing is static in life. Our assets and debts today might not be the same in 5 or 10 years time let alone 15 or 20 years.

- How your dependents could create an income stream with the lump sum payment they'll receive. The money needed to invest to deliver a living wage of sufficient income.

- The level of debt you expect to carry in the future. As your pay off your mortgage the debt will of course decrease.

Life insurance is all about protecting your loved ones, or creditors, against any future adverse happening to yourself. It's therefore a means of risk protection planning for the future.

Life Insurance

Life insurance is insurance which primarily covers you for death. It pays a lump sum to the surviving family members or beneficiaries after the insured’s death. Therefore, it can serve as a basis for financial security and protection.

Other benefits of life insurance are to:

- Reimburse funeral costs

- Pay off mortgage and other financial obligations that have been left by the insured behind

- Take care of your estate planning needs

- Pay for other extra expenses your family might need, like child care

- Provide a reserve for the remaining spouse should he or she decides not to work anymore