Changing markets must be viewed with clear lenses.

Often we find ourselves stuck in the habit of doing something, whether it be an action or task. Many of us then find it even more increasingly difficult to break out of. The same can be said for investing, where they are a number of different investors who get stuck in the actions or habits of those around them. Therefore, ultimately affecting their cognitive ability to concentrate and register all areas and events in the market leading to concentration being placed on certain aspects of market areas. This is considered high-risk when you ignore other areas affecting your investment decisions.

Some investors purely hold property portfolios as they consider this the ‘perfect nest egg’ for their retirement. However while they may be diversified within that asset class they have concentrated their wealth into one area of the market – there are many more asset classes and investment types available. The same can be said for some share-traders who may purely hold equities in their portfolios and rely upon this asset class to help them achieve their financial goals and objectives. Familiarity with what investments we know is one area where some of us go wrong. Often investors only know of certain investments from their family, friends or news and television media.

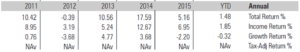

When trying to forecast what will happen in the market(s) in which we hold investments, many investors come undone. Forecasting is something we all do whether we believe in it or not. Often we use tables of data like that of the following to make our decisions.

What will revenue, growth and total return on your investments be for 2016/17 financial year?

In your head you may already have a figure that depicts the return you think you will receive. We all have some degree of knowledge and prediction about what our investments will yield for the year or whichever time period we are discussing. Many different outcomes could occur in the short, medium and long term future of your investments, which is why ongoing advice and monitoring of your investments plays a crucial role. You must ask yourself… would I be happy with the forward thinking forecasts I made if tomorrow my investments fell by 5%..10%…20%…50%. The greater the level of investment expertise and rigour that is placed on your investment decisions and analysis of markets the more informed you will be to make good investment decisions.

We now face a time in our investment outlook for the future that is increasingly difficult to decipher and predict what the outcome will be. Now is the time to take advantage of diversification and review your existing holdings to determine whether you may be over allocated or exposed with the investments you hold.

Total Advice Partners are available now to assist you with all of your enquiries. Please feel free to contact us at any time to discuss your situation and financial needs. We are happy to provide comment on all major asset classes including direct, listed and unlisted property classes also.

(P) (07) 3284 7875 | (F) (07) 3284 4790